How to Start a SIP in India: A Step-by-Step Guide for Beginners (2025)

Why Start a SIP? Benefits for Indian Investors

A Systematic Investment Plan (SIP) is the easiest way for beginners to enter the world of mutual funds. Learn more about how to start a SIP in India with this step-by-step Guide for Beginners and know why over 4.5 crore Indians use SIPs:

- Affordable: Start with just ₹500/month.

- Disciplined Investing: Automate savings for goals like education, travel, or retirement.

- Rupee Cost Averaging: Minimize market volatility risks.

- Flexibility: Pause, increase, or stop SIPs anytime.

Pro Tip: For a deep dive into SIP benefits, read our Ultimate Guide to SIP Investments.

Step 1: Define Your Financial Goal

Your SIP strategy depends on your goal’s timeline and risk appetite:

| Goal Type | Recommended SIP | Example |

|---|---|---|

| Short-Term (1–3 years) | Debt funds or hybrid funds | Saving for a vacation or emergency fund |

| Mid-Term (3–5 years) | Balanced advantage funds | Down payment for a car |

| Long-Term (5+ years) | Equity funds (large/mid-cap) | Retirement or child’s education |

Case Study: Priya, 28, invests ₹10,000/month in Axis Bluechip Fund for a ₹50L home down payment in 10 years. Use our SIP Calculator to plan your goal.

Step 2: Choose the Right SIP Fund (With Examples)

Factors to Consider:

- Risk Appetite: Equity (high risk), hybrid (medium), debt (low).

- Past Performance: Check 5–7 year CAGR (avoid short-term trends).

- Expense Ratio: Lower is better (ideally under 1.5%).

- Fund Manager Reputation: Look for consistency.

Top SIP Funds for Beginners (2024):

- Axis Bluechip Fund (Large-cap equity, 12.8% CAGR)

- SBI Balanced Advantage Fund (Hybrid, 10.5% CAGR)

- HDFC Index Nifty 50 Fund (Low-cost passive fund)

Need Help? Explore our curated list of Top 5 SIPs for 2025.

Step 3: Complete KYC Compliance (Documents Required)

KYC (Know Your Customer) is mandatory for SIPs. Here’s how to do it:

- Documents Needed:

- PAN card

- Aadhaar card

- Bank proof (passbook or canceled cheque)

- Process:

- Online: Submit scanned copies via AMC/broker portal (e.g., Groww, Coin by Zerodha).

- Offline: Visit a fund office or KYC kiosk.

Note: e-KYC takes 24–48 hours. Track status via CDSL’s KYC portal.

Step 4: Select a Platform (AMC vs. Broker vs. Fintech Apps)

| Platform | Pros | Cons |

|---|---|---|

| AMC Websites | Direct investing, no brokerage fees | Limited fund choices |

| Brokers (Zerodha, Groww) | Wide fund selection, advanced tools | ₹10–30 transaction fees |

| Fintech Apps (Paytm Money, ET Money) | User-friendly, goal-based features | Higher expense ratios |

Pro Tip: Compare platforms in our Best SIP Apps for 2025 guide.

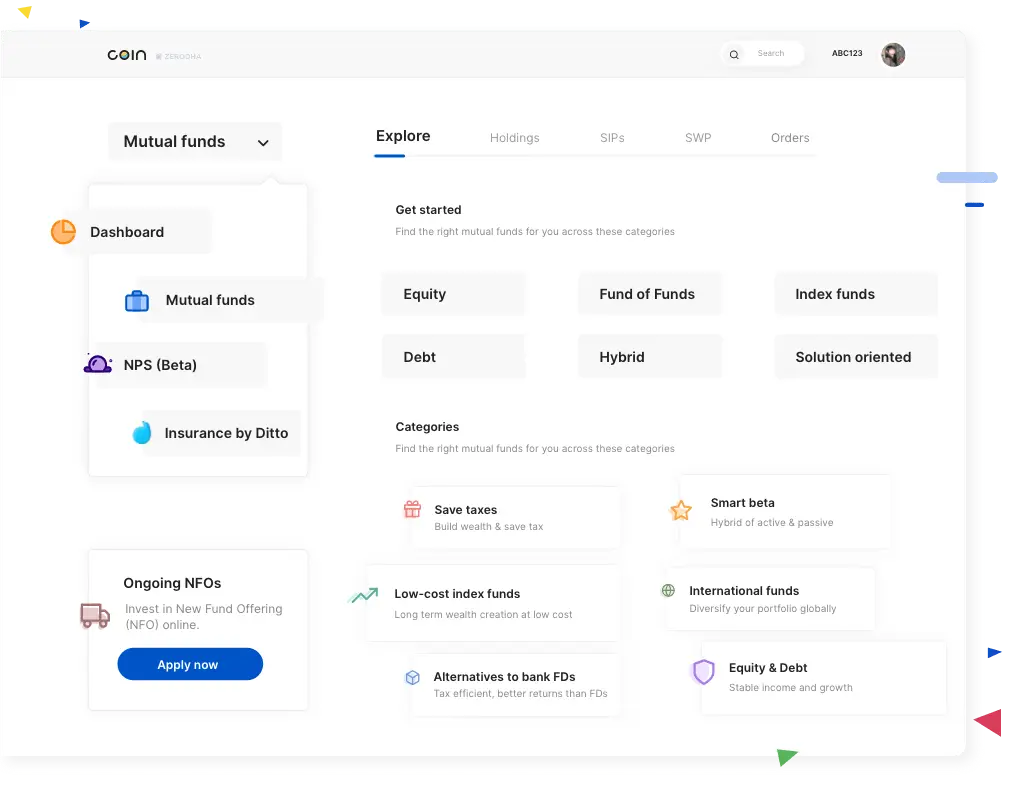

Step 5: Set Up Auto-Debit & Start Investing

- Log in to your chosen platform.

- Select a Fund: Search for your pre-researched SIP (e.g., Parag Parikh Flexi Cap Fund).

- Set SIP Details:

- Amount (₹500–₹1,00,000/month)

- Date (1st–28th of the month)

- Duration (6 months to perpetual)

- Link Bank Account: Enable auto-debit via Net Banking/UPI.

Screenshot Walkthrough:

Step 6: Monitor & Adjust Your SIP (Pro Tips)

- Track Performance: Use apps like ET Money or Moneycontrol.

- Rebalance Annually: Shift from equity to debt as you near your goal.

- Increase SIP Amount: Boost by 10% yearly to counter inflation.

Tool: Download our free SIP Tracker Template to automate monitoring.

Common Mistakes to Avoid (Linked to Pillar Guide)

- Overloading on Too Many Funds: Stick to 3–5 SIPs for focus.

- Ignoring Expense Ratios: High fees eat into long-term returns.

- Stopping SIPs During Market Dips: Stay disciplined!

Learn More: 7 Deadly SIP Mistakes to Avoid.

FAQs on Starting a SIP

Q1. What is the minimum SIP amount?

Most funds allow ₹500/month, but some start at ₹100 (e.g., Nippon India Growth Fund).

Q2. Can I pause a SIP?

Yes, but avoid frequent pauses. Use flexible SIPs for irregular income.

Q3. How to track my SIP?

Use your AMC/broker app or third-party tools like Value Research.

Q4. Are SIPs taxable?

Yes, but ELSS SIPs offer tax benefits. Read our SIP tax guide.

Free Resources

- Download: SIP Starter Checklist (Covers KYC, fund selection, and tracking).

- Watch: How to Start a SIP on Groww (5-minute tutorial).

Starting a SIP is simpler than you think! With just ₹500, a smartphone, and 15 minutes, you can begin your wealth-building journey today. Remember, consistency is key—even small amounts grow into life-changing sums over time. Learn more about how to start a SIP in India with this step-by-step Guide for Beginners and start your journey of financial independence.

Next Steps:

- Explore More: Dive into SIP tax benefits or SIP vs. Lumpsum.

- Begin Now: Open your Demat account and pick your first fund!

3 Replies to “How to Start a SIP in India: A Step-by-Step Guide for Beginners (2025)”